Our Offshore Trust Services PDFs

Wiki Article

How Offshore Trust Services can Save You Time, Stress, and Money.

Table of ContentsThings about Offshore Trust ServicesThe 15-Second Trick For Offshore Trust ServicesThings about Offshore Trust ServicesOffshore Trust Services Things To Know Before You BuyAbout Offshore Trust Services

Even if a creditor can bring a fraudulent transfer claim, it is hard to succeed. They should confirm past a reasonable doubt that the transfer was made with the intent to rip off that specific lender which the transfer left the debtor financially troubled. Lots of offshore property protection intends involve even more than one legal entity.

, which for some time has actually been a popular LLC territory. Recent changes to Nevis tax as well as filing demands have actually led to LLCs in the Chef Islands.

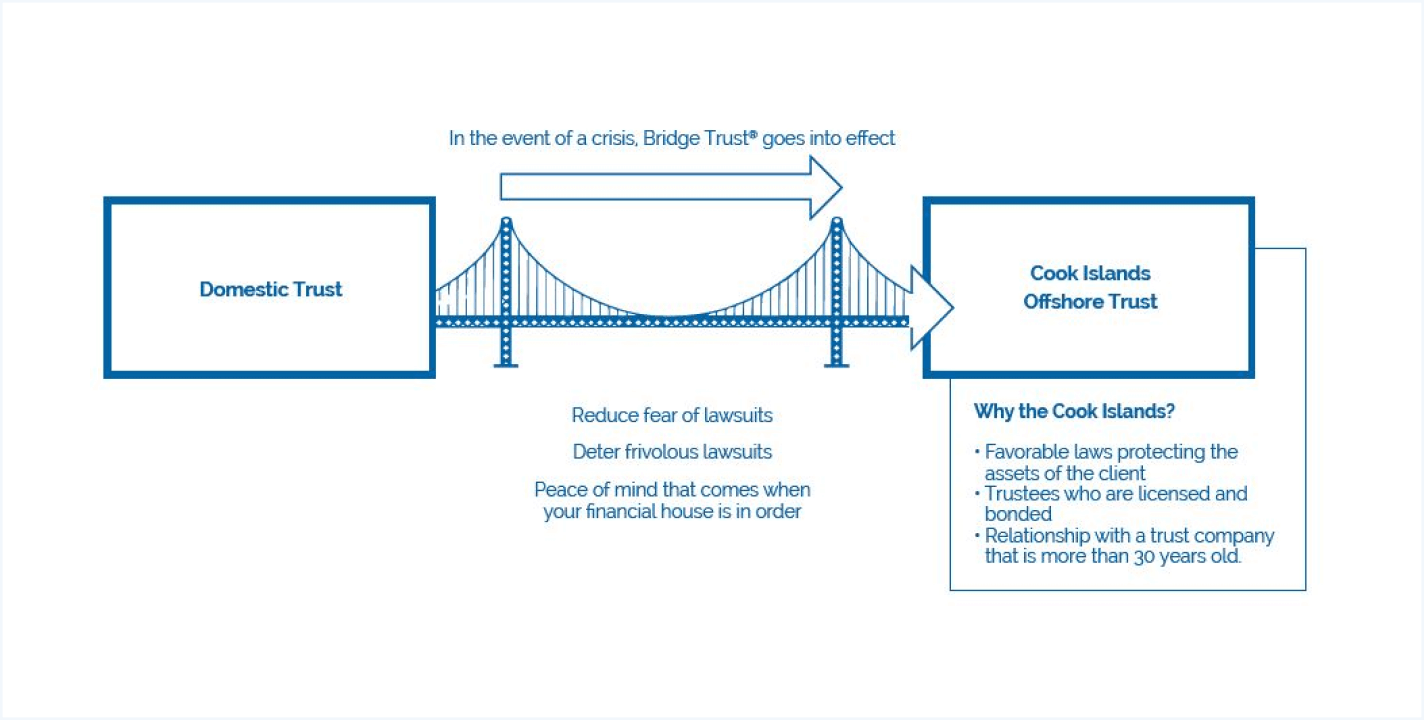

individual can develop a Nevis LLC and also transfer their business passions and fluid possessions to the LLC. The person could next off develop a Cook Islands trust fund using an overseas depend on business as a trustee. The LLC issues subscription rate of interests to the trustee of the Cook Islands trust. The Chef Islands trust would certainly have 100% of the Nevis LLC.

With this kind of offshore trust structure, the Nevis LLC is managed by the United state person when there are no expected suits. Once a legal concern emerges, the trustee of the overseas trust fund ought to remove the U.S

Offer all called for documents for the trustee's due persistance. Prepare the overseas trust fund file with your attorney. Fund the depend on by moving residential assets to the overseas accounts. The primary step to developing an offshore trust is picking a count on jurisdiction. offshore trust services. In our experience, the Chef Islands provides the very best combination of trustee guideline, desirable debtor regulations, as well as positive lawsuits outcomes compared to various other jurisdictions.

The trustee business will utilize software application to confirm your identity as well as explore your current legal situation in the united state Trust companies do not desire clients who might entail the business in investigations or litigation, such as disagreements entailing the U.S. government. You should reveal pending litigation and also investigations as part of the background check.

How Offshore Trust Services can Save You Time, Stress, and Money.

Your domestic property security More hints lawyer will work with the offshore trustee firm to compose the offshore count on arrangement. The trust fund agreement can be tailored based on your possession security as well as estate planning goals.

bookkeeping firms, as well as they use the audit results as well as their insurance certificates to potential overseas trust fund customers. Lots of people wish to retain control i loved this of their very own assets kept in their overseas trust by having the power to eliminate and also change the trustee. Preserving the power to change an offshore trustee produces legal threats.

Offshore trust fund possession defense functions best if the trustmaker has no control over depend on assets or various other parties to the trust. Some trustee business allow the trustmaker to get key discretion over trust fund financial read the article investments and account administration in the position of count on advisor.

The trustmaker does not have straight access to overseas trust fund financial accounts, but they can ask for circulations from the overseas trustee The opportunity of turn over orders and civil contempt fees is a considerable danger in offshore asset defense. Borrowers counting on overseas trust funds must consider the possibility of a domestic court order to bring back properties moved to a borrower's overseas trust fund.

In instances when a court orders a borrower to relax an offshore depend on strategy, the borrower can declare that conformity is difficult due to the fact that the trust fund is under the control of an offshore trustee. Some current court choices deal with a transfer of assets to an offshore depend on as a deliberate act of developing an unfeasibility.

The borrower had transferred over $7 million to an overseas trustee. The trustee then transferred the exact same money to a foreign LLC of which the borrower was the single member.

Getting The Offshore Trust Services To Work

The offshore trustee refused, as well as he claimed that the cash had been purchased the LLC (offshore trust services). The court held the debtor in contempt of court. The court discovered that regardless of the rejection by the offshore trustee, the debtor still had the capability to access the funds as the sole member of the LLC.Report this wiki page